What is product-market fit?

For early stage startups (pre-Seed and Seed) there is only one thing founders should obsess about: finding product-market fit (PMF). As the company gets started, it is much better to have a small group of customers (ideally acquired at a low cost) highly engaged with your product than a large audience that superficially engages. I am convinced that a company has achieved product-market fit when a relevant part of their users demonstrates to love the product so that they pay the right price, recommend it to other users and use it again. It’s important to highlight “paying the right price”, because constantly offering a product or service subsidized leads to a false positive result. It’s better not to deceive oneself and to look at the data in a cold and objective manner, practicing the right price (meaning a healthy contribution margin, ideally above 50% for software).

A clear example is iFood: back in 2017 I was the Chief Strategist when we analyzed our customer cohorts and it was evident that for every 100 customers who ordered food for the first time, 30 would keep purchasing at least once a month for the next 30 months (that was the cut for life time value (LTV) back then). This, combined with data on user and restaurant profiles in most Brazilian cities, made internal investment decisions easy: we knew the LTV of each customer and were willing to invest up to 30% of that amount to acquire new users, understanding that the untapped market was huge (back then most people were still ordering food through the phone). The internal data on customer behavior (retention and reorder rate) proved product-market fit, which combined with the external data on the size of the opportunity made it obvious for investors that the company would turn investors’ money into valuable customers who would stick around for the long-run and pay for their service. A company with clear PMF and a large, fragmented, addressable market is an amazing asset to investors as it can leverage capital to create a dominant player that at some point will generate handsome cashflows. Of course markets are smart and there are competitive pressures in industries that grow fast and with margins, so innovation, focus and execution ability are key to win. Here we know the story of intense competition with UberEats and Rappi.

The goal of a pre-Series A company is to prove PMF, so all company resources should be dedicated to it. The CEO should do all sales in the beginning, the CTO should be talking to customers frequently to understand user pain points directly, marketing should be hyper segmented to understand the messages that resonate the best with different target audiences that may best engage with the product. Raising a Series A without PMF should be interpreted as a sign of “the market is giving us a second chance to prove PMF”, and not as if the company is all set to grow doing more of the same and there’s only reason to celebrate.

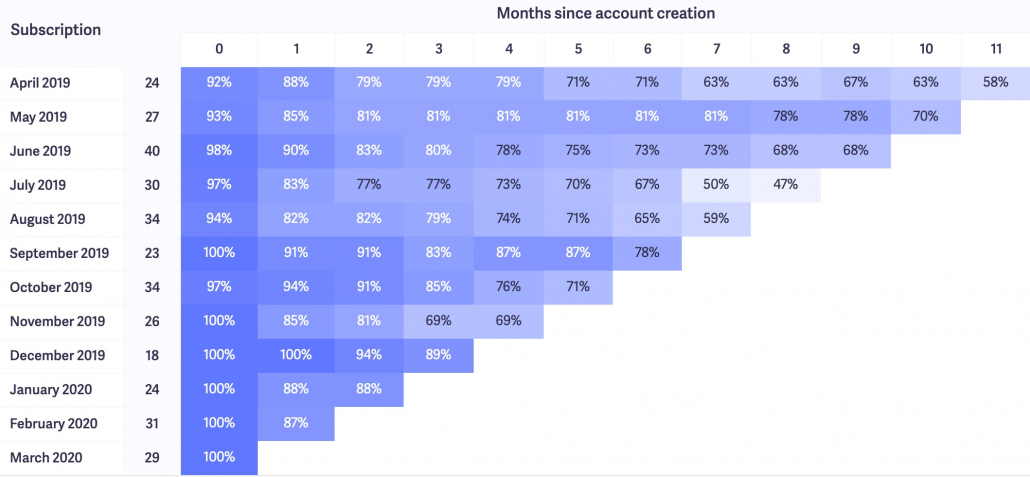

Below is a dummy example of a beautiful cohort analysis showing the percentage of users who remain active since account creation, using the product with a minimum frequency to be defined as “active” (can vary from daily to monthly use). How do your cohorts compare?

Finding PMF is difficult, and only a few companies achieve it with their initial product. After pre-Seed and Seed rounds of fundraising, I have seen teams pivoting and eventually finding something that works, but the reality is: the more knowledge you have about the problem you want to solve, who your customer is, and the solution you want to offer, the greater the chances of hitting the target and starting your company off on the right foot. It’s much cheaper to test the actual size of the problem, the ideal user, and the attractiveness of your solution before raising a hefty investment round.

Leave a Reply

Want to join the discussion?Feel free to contribute!